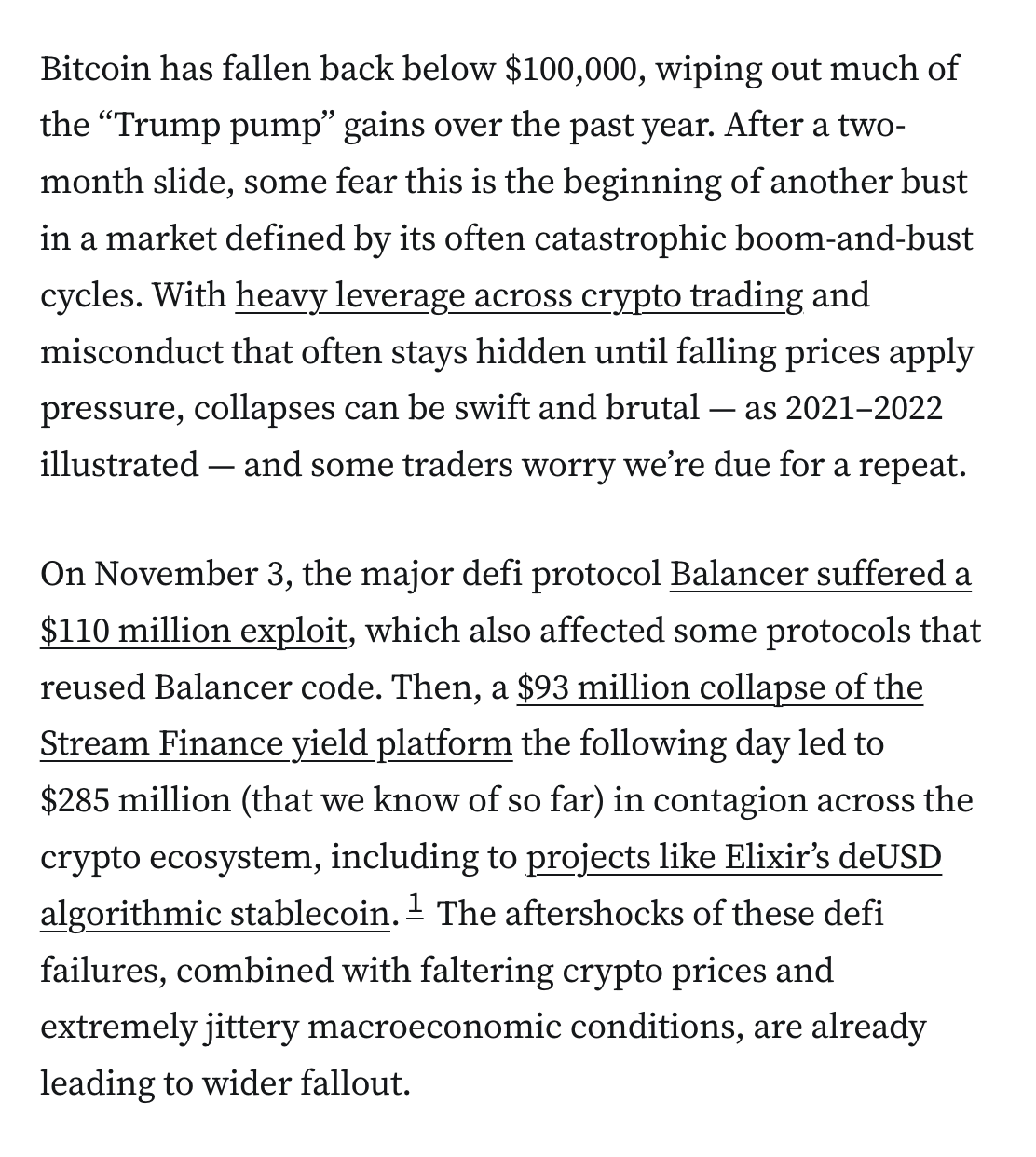

Trump has announced a partnership with a Saudi firm to create a new Trump hotel in the Maldives. He plans to fund it by “tokeniz[ing] the development phase” and selling the tokens to US retail crypto traders.

Under any pre-Trump SEC, the tokenized hotel development would likely be considered a securities offering, with risk disclosures and protections aimed at keeping everyday people from being fleeced. But Trump’s SEC picks seem more occupied with advancing his crypto ambitions.

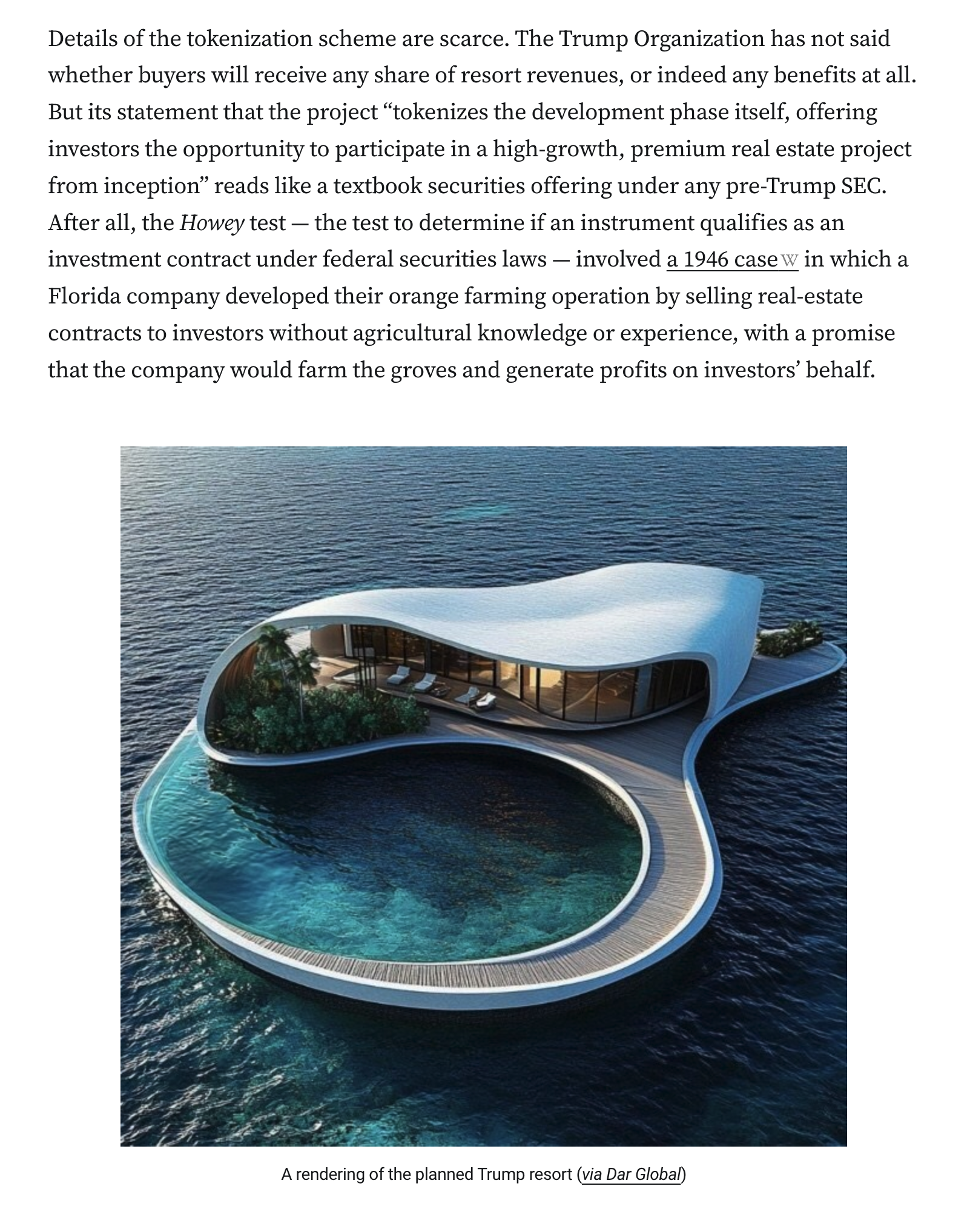

The hotel project is being developed with Saudi partners, making it another arrangement that boosts Trump’s crypto ventures while White House actions benefit the same government. The hotel announcement landed the same day Trump approved selling F-35s to Saudi Arabia.

#crypto #cryptocurrency #USpolitics #USpol #CitationNeededNewsletter

![Trump business interests

Newest on President Trump’s rapidly expanding list of crypto ventures is a Trump-branded hotel and resort in the Maldives, which the Trump Organization says will be financed by “tokenizing” the project’s construction phase on a blockchain and selling the tokens to US retail investors.34 The Trump sons and some of their crypto business partners have lately been eagerly pitching the idea of new projects involving both real estate and blockchains [I94], which they present as an opportunity for retail investors who they claim have been unfairly excluded from high-risk real estate investments — rather than what it plainly is: an opportunity for Trump to start bilking everyday people as well as institutional lenders, contractors, and laborers.](https://media.hachyderm.io/media_attachments/files/115/578/697/407/860/872/original/c54a7ced01241857.png)

![The project is being developed with the Saudi company Dar Global, continuing the now-familiar pattern of lucrative Trump administration and family deals with Persian Gulf governments and companies. Congressional and public outcry over apparent corruption and ethics violations involving a $2 billion UAE investment in Binance denominated in the Trump family’s stablecoin (which would route tens of millions in interest on the reserves to the Trumps) [I83], a White House–brokered AI-chips deal with the UAE [I93], and another White House deal granting the UAE a 15% stake in TikTok [I94] evidently have not slowed Trump’s pursuit of similar arrangements.](https://media.hachyderm.io/media_attachments/files/115/578/698/274/694/024/original/18fcd813ed366721.png)